Navigating the world of car insurance can be a daunting task, especially when you’re looking for coverage that’s both comprehensive and affordable. However, with a little bit of know-how and some strategic planning, you can find a policy that fits your needs without breaking the bank. In this article, we’ll share some practical tips for getting affordable car insurance quotes, helping you to save money while staying protected on the road.

Understand Your Insurance Needs

Before diving into the search for car insurance quotes, it’s crucial to have a clear understanding of your insurance needs. Consider factors such as your vehicle’s value, your driving habits, and any specific coverage requirements you might have. This will help you avoid paying for unnecessary coverage and focus on what’s truly important for your situation.

Shop Around and Compare Quotes

One of the most effective ways to find an affordable car insurance policy is to shop around and compare quotes from multiple insurers. Prices can vary significantly from one company to another, so it’s worth taking the time to explore your options. Use online comparison tools to get a broad view of the market and reach out to insurance agents for personalized quotes.

Take Advantage of Discounts

Many insurance companies offer a variety of discounts that can significantly reduce your premiums. These may include discounts for safe driving, having multiple policies with the same insurer, or installing safety devices in your vehicle. Make sure to inquire about available discounts when getting quotes and take steps to qualify for as many as possible.

Opt for a Higher Deductible

Choosing a higher deductible can be a simple way to lower your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By agreeing to pay a higher deductible in the event of a claim, you can reduce your monthly or annual insurance costs. Just be sure to choose a deductible amount that you can comfortably afford if you need to make a claim.

Maintain a Good Driving Record

Your driving record is one of the key factors that insurers consider when determining your insurance rates. Drivers with a history of accidents or traffic violations are typically charged higher premiums. To get the best possible rates, strive to maintain a clean driving record by driving safely and adhering to traffic laws.

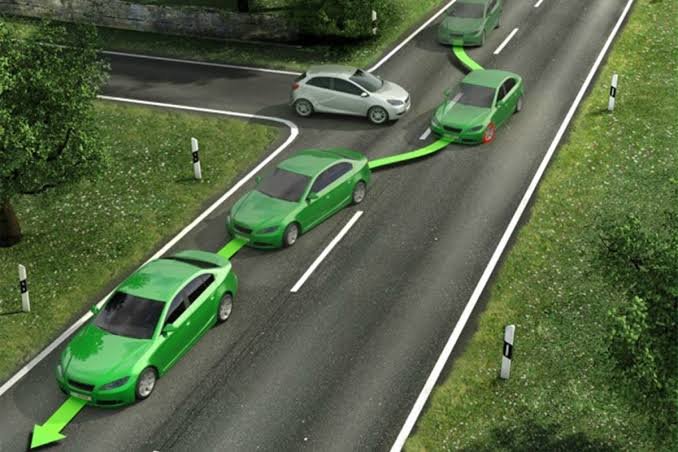

Consider Usage-Based Insurance

Usage-based insurance (UBI) is a type of car insurance where your premiums are based on your actual driving behaviour. If you’re a safe, low-mileage driver, UBI can offer significant savings. Many insurers offer telematics devices or mobile apps that monitor your driving habits and adjust your rates accordingly.

Review and Update Your Policy Regularly

Your insurance needs can change over time, so it’s important to review and update your policy regularly. This can be especially true if you’ve made changes to your vehicle, altered your driving habits, or experienced life changes such as moving to a new area. Regularly reviewing your policy ensures that you’re not overpaying for coverage that no longer suits your needs.

Finding affordable car insurance doesn’t have to be a challenging endeavour. By understanding your insurance needs, shopping around, taking advantage of discounts, and maintaining a good driving record, you can secure a policy that offers both value and protection. Remember, the cheapest option isn’t always the best—focus on finding a balance between affordability and comprehensive coverage to keep yourself well-protected on the road.